According to TrendForce, the independent new energy research agency, cumulative shipments of 210mm modules have exceeded 120GW, and the power of 210mm n-type modules has passed 700W. TrendForce estimates in its recent report that in 2023, large-format wafers, cells and modules will account for more than 90% of the total production capacity, and demand for large-format products will demonstrate a strong growth.

Production capacity will exceed 90%, with 210mm modules accounting for nearly 60% of total production capacity

In terms of wafers, TrendForce expects a faster increase in demand for large-format wafers in 2023, with its market share increasing rapidly from 83.45% in 2022 to 95.74%. In 2023, the production capacity for large-format wafers will hit 792.4GW, showing a stronger tendency toward larger formats, while 210mm wafer production capacity will hit 320.8GW, increasing by 74.6%, with a market share of 38.76%.

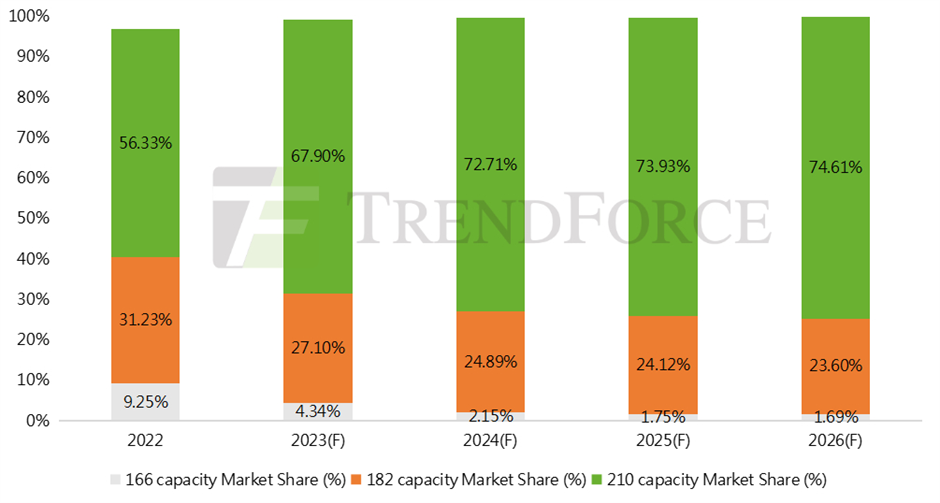

Figure: Capacity ratio for wafers of different sizes between 2022 and 2026 (Unit: %)

(Source: TrendForce)

In terms of cells, the capacity for large-format cells will reach 822.3GW in 2023, accounting for 94.99% of total capacity. 210mm cell capacity will reach 587.75GW, an increase of 83.7% from 2022, with a market share of 67.9%.

Figure: Capacity ratio of large-format cells (Unit: %)

(Source: TrendForce)

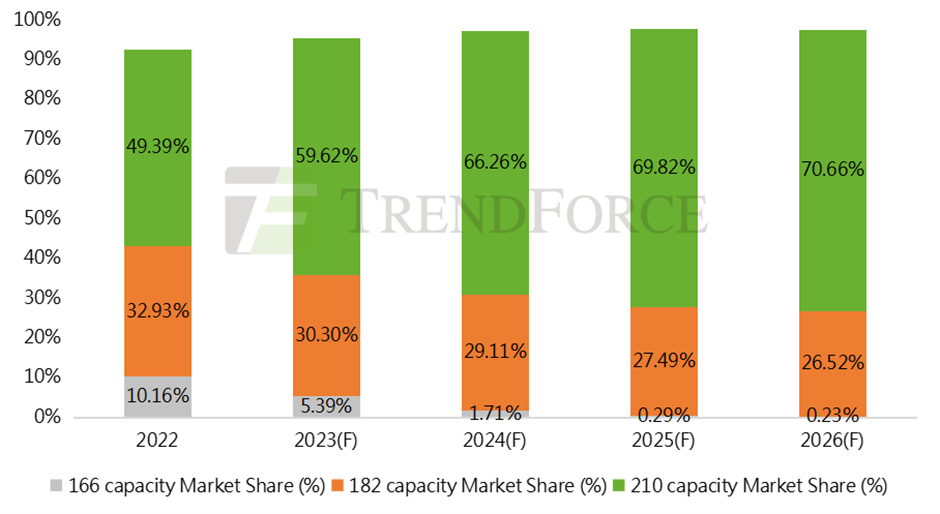

On the module front, TrendForce anticipates a significant increase in production capacity for large-format modules in 2023, reaching 767 GW with a market share of around 90%. Among them, 210mm module capacity will reach 508GW, a 68.14% increase from 2022, with a market share of 59.62%, indicating continued strong growth.

Figure: Market share of modules (Unit: %)

(Source: TrendForce)

Bidding trends: High power modules dominate, with large-format modules accounting for 89.21%

In terms of bidding trends, projects clearly favor large-format modules. According to TrendForce, high power modules are in demand among the nearly 129GW centralized procurement of PV modules announced by COEs and SOEs in 2022, with large-format modules dominating. Over 115GW of the bidding projects specifically require 182/210mm modules, accounting for 89.21%, indicating an increasing demand for large-format modules, which is a key component of the industry chain for reducing costs and increasing efficiency.

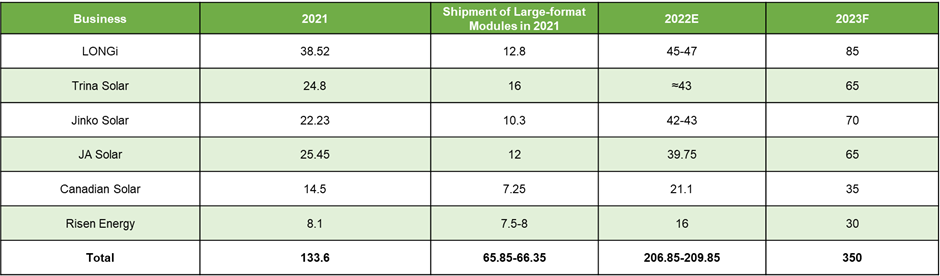

The shipments of the first-tier module manufacturers in 2022 all exceeded 40GW, and the cumulative shipments of 210mm modules exceeded 120GW

According to TrendForce, the top six module manufacturers’ shipments in 2022 were around 205-211GW, accounting for 76-78% of the annual module demand of 270GW. Among them, LONGi, Trina Solar and JinkoSolar all shipped more than 40GW. In 2022, shipments of large-format modules grew at a faster rate, accounting for more than 80% of total shipments. As of the first quarter of 2023, the cumulative shipments of 210mm modules had exceeded 120GW. Shipments of large-format modules will continue to rise as market demand and production capacity expand.

Figure: Shipments of leading module manufacturers (Unit: GW)

(Source: TrendForce)

Technology development: the combination of 210mm and n-type technology supports module power output to exceed 700W

The combination of large-format and n-type technology has become an inevitable trend. The power of 182mm n-type modules increases from 500W+ to 600W+, while the power of 210mm n-type modules exceeds 700W.

With the large-format products develop rapidly and advanced technologies such as n-type mature, 210mm products have already become the mainstream in the PV industry and will continue to dominate the market.

Relevant Topics

Smart Energy Solutions

delivered straight to your inbox

More Events